mainstreet memories, 2025.

a joyride down memory lane.

what is mainstreet media?

mainstreet media is the cultural engine for private capital.

We tell stories about the world’s greatest investment firms, spotlight athletes building ownership in the shadows, and offer insider information on startups.

Legacy: exclusive interviews featuring athletes building wealth beyond sports

Series: deep dives on the world’s most prolific venture capital firms

Memos: musings on the deals shaping private markets today

Watchlist: insider stories on startups built for serious scale (coming soon in 2026)

In a world filled with noise, we aim to deliver signal.

For your eyes only.

best of legacy, 2025.

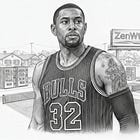

Is C.J. Watson Building a Modern Day Berkshire Hathaway?

An exclusive interview with former NBA guard C.J. Watson, covering every angle on his business endeavors.

From NFL to Acai Bowls: How Henry Anderson is Building a Multi-Million Dollar Franchise Empire

An exclusive interview with former NFL defensive lineman Henry Anderson on his acai bowl franchise.

How Kyle Roig Is Redefining Luxury Travel And Earning the Trust of the World’s Top 1%

An exclusive interview with former LPGA golfer Kyle Roig on how she serves the world’s top 1%.

Infiltrating Silicon Valley: How Chase Garbers Is Hunting Unicorns

An exclusive interview with former NFL quarterback Chase Garbers on his journey to becoming an avid angel investor.

best of series, 2025.

The USV Story: Domino Effect

Parallels between Union Square Ventures and the San Antonio Spurs.

Ubiquitous.

A colorful narrative of the Uber saga from start to finish.

Andressen Horowitz I.

a16z is the greatest venture firm in the world.

To Be Reproduced.

A transparent look into the origins of OpenAI.

best of memos, 2025.

Master Gardener: Radices

Deep sea dive into the history of college endowments.

“There are consultants that work with Harvard and Yale and Cornell and they are also the consultants that work with the managers themselves and they’re extremely powerful and they’re a key constituency in the whole puzzle… those institutions play an incredibly important role because they’re not only gatekeepers, but they’re also toll collectors. Like they can put the gate down, but then they can also open up the easy pass lane.”

Jarett Wait, ex-Lehman Brothers Asia CEO, to mainstreet media.

“Private equity used to be opportunistic. The S&P 500 is liquid. There’s a difference. There should be a liquidity premium for private equity, but there’s actually a liquidity discount right now.”

Professor Edwin Burton, University of Virginia, to mainstreet media.

The Winning Bid.

An exclusive interview with the man who squared up with eBay and PayPal during the dot-com boom.

“Be careful as to how much you divulge about your company, about the inner workings. We thought they (eBay) were there to buy us and they were just there to get information on what we were doing.”

Michael Capelli, serial entrepreneur + co-founder of Level2, to mainstreet media.

mainstreet reading list, 2025.

Same as Ever by Morgan Housel.

Slow Productivity by Cal Newport.

Angel by Jason Calacanis.

The Real Presence by Peter Eymard.

Dark Pools by Scott Patterson.

Empire of AI by Karen Hao.

If you want to go deeper:

Great year-end wrap of your work covering private capital through the athlete lens. The CJ Watson Berkshire comparison is clever - finding parallels between concentrated long term holdings and athlete-turned-investor portfolios. The endowments piece (Master Gardener) touched on somthing underexplored: how consultants essentially gatekeep both university capital AND the managers receiving it, creating a unique dual-sided power structure. That toll-collector metaphor from Jarett Wait captures somethng most outside observers miss about how capital actualy flows in these ecosytems.