The Winning Bid.

meet the man who squared up with eBay and PayPal during the dot-com boom. Michael Capelli sits down with mainstreet media.

Once Michael realized he wasn’t going to make it, dread seeped into every part of his body.

Time seemed to freeze, and he drifted into intense flashbacks of his family gathering together for the Thanksgiving holiday.

His mom’s pasta, clothed with alfredo.

Children laughing, rich with joy.

Conversations with his father.

In this moment of tension, he longed for that same intense familial love.

It all seemed so impossibly distant.

With the iota of willpower he had remaining, Michael picked up the phone to call his mother.

Hello?

Hey mom, it’s Mike… Yeah, I just wanted to let you know that I won’t be home for Thanksgiving this year.

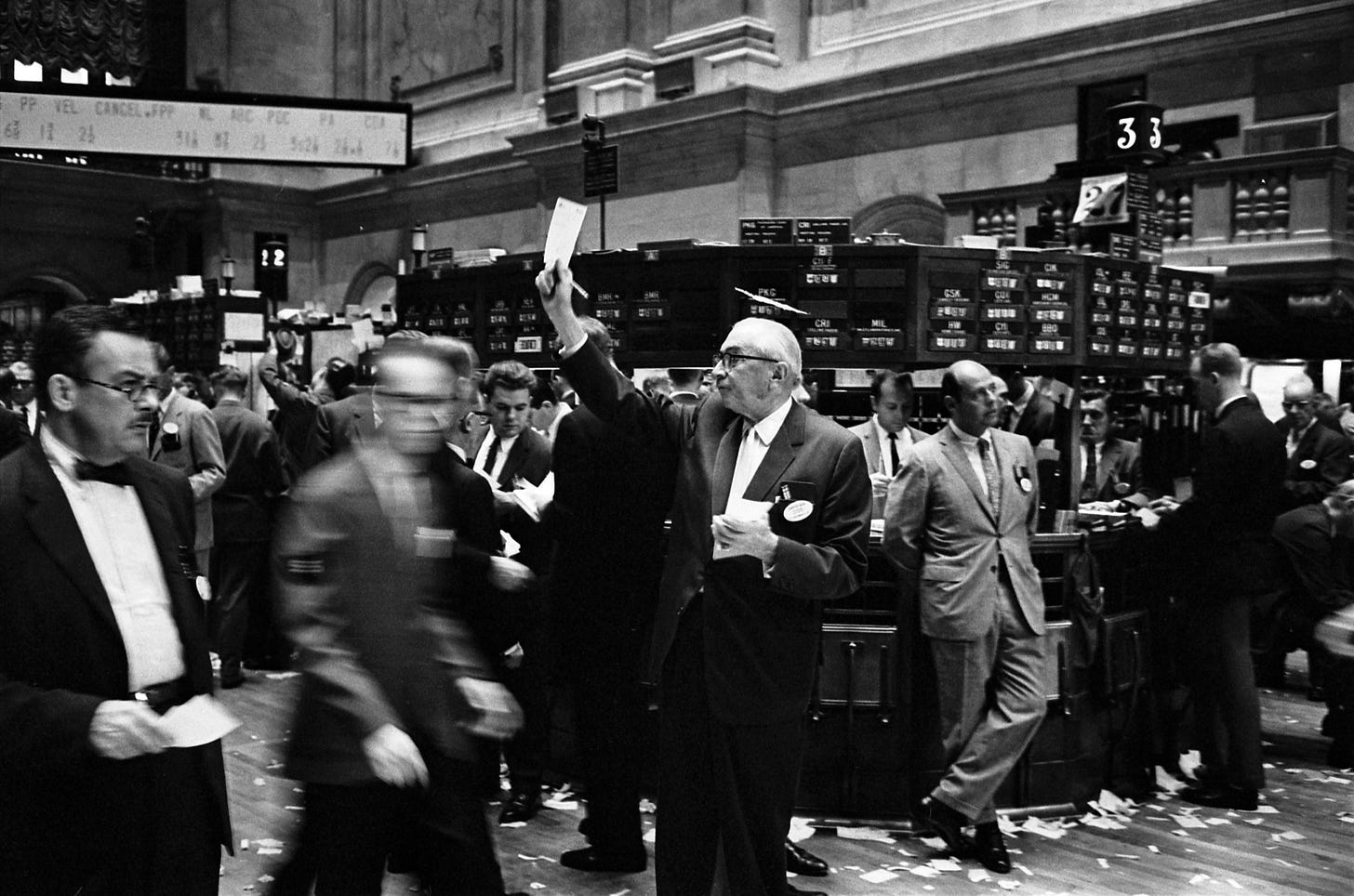

The year was 1999 and Michael Capelli was getting started on Wall Street. He had previously graduated from NYU with a Math degree, before flirting with medical school for one year, deciding against it, and graduating from the MBA program at NYU Stern, one of the top business schools in the country. Life was anything but a straight path. Capelli embraced that.

After NYU Stern, he landed a sales-trading role at Investment Technology Group (ITG) in 1994 and carved out a position as an up and coming star on the trading floor. His secret weapon was an ability to let others talk while he listened; Mike had a warm humility that stood out in the arena of ego driven dealmaking.

But we’re not here to talk about Capelli’s role at ITG.

We’re here to hear what went on after hours.

Let me start by saying this: 1999 was quite the year.

President Bill Clinton beat his impeachment case.

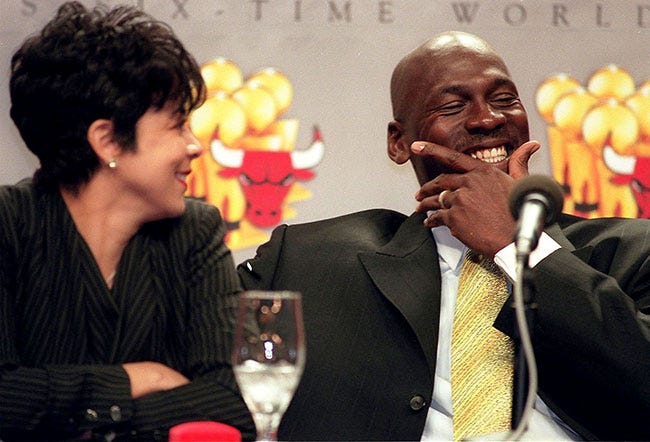

Michael Jordan retired after winning his final championship.

Google raised $25M from Sequoia and Kleiner Perkins.

Mike Capelli was living with his friend, Steve Chin, who owned and operated a check cashing business in New York.

One day, he bought a computer off eBay and discovered how terrible the payment process was.

“I bought a computer off eBay and there was no way of paying for it. Steve owned a check cashing store, so I go down to his store, get a money order, write a cover letter to the seller of the computer, mail it to them out in California, wait five days for it to get to him, wait another five days for the check to clear, and then wait a week for that product to come to New York. So you're looking at three, four weeks, you know, to get this product. We looked at it and my thought at the time was, ‘This is ridiculous. It's going to take forever.’”

Michael Capelli to mainstreet.

As Mike and Steve lamented over the amount of friction in paying for products on eBay, a lightbulb began to glow.

Later that night, Steve woke Mike up and told him they had to build the technology to power payments on eBay.

Mike was in.

“When we asked people what they thought about what we were doing, there were two predominant responses. The first was, the Internet’s a fad… The second was, it's not going to work because if this was a good idea, someone would have done it by now. And why are you two guys who know nothing about payments going to succeed?”

Michael Capelli to mainstreet.

As the two founders began to build the product, Mike was still working at ITG.

His workday was brutal.

He would start early in the morning as a sales-trader at ITG and work into the evenings. Then he’d leave the office, grab dinner with Steve and talk about their startup, BidPay, then go to a small office they were renting on Broadway and Chamber Street. They’d work late into the night, then Mike would rush home, get some sleep, and check into the ITG office the next day like nothing happened.

The next year, things began to pick up.

There was no time for downtime.

Capelli recalls going to the beach with his girlfriend one weekend and just sleeping on the sand the entire time. His friends couldn’t understand the exhaustion. But business was booming.

Tension peaked when the holidays came around.

“I remember at Thanksgiving I had to call my mom to tell her I couldn't go to Thanksgiving because we were so busy with orders that we had to catch up. We needed Thanksgiving to catch up because it was slow. People were having turkey. So Steve and I said, ‘All right, well, let's just use this as an opportunity to catch up.’ Needless to say, my mom was not happy…”

Michael Capelli to mainstreet.

It’s important to remember the competitive landscape at this time.

Confinity was a Palo Alto based startup founded in 1998 by Luke Nosek, Peter Thiel, Max Levchin, Yu Pan, and Ken Howery.

X.com was a Palo Alto based startup founded in 1999 by Elon Musk.

Confinity raised a $3M round from Nokia Ventures and Deutsche Bank in 1999 to facilitate money transfers through PalmPilots. Eventually, they pivoted to money transfers through email.

X.com raised $10M from Sequoia Capital in 1999 to build an online banking startup that offered checking, insurance, mutual funds, and payments. After the launch in the winter of ‘99, the founders found that peer-to-peer payments was what the people really wanted.

In March 2000, the two companies merged, forming what we know now as PayPal. They focused intensely on their core customer - eBay users.

In fact, at PayPal’s peak, they were spending over $100,000 per day providing incentives for eBay user referrals and sign-ups.

The merger allowed PayPal to consolidate their respective millions of dollars raised to fuel growth.

But the consolidation of talent might have been more important.

For a startup, PayPal had the deepest roster of all-time:

Elon Musk (founder of Tesla, SpaceX, The Boring Company)

Peter Thiel (founder of Palantir, Founder’s Fund, Clarium Capital)

Reid Hoffman (founder of LinkedIn)

David Sacks (founder of Yammer)

Steven Chen (co-founder of YouTube)

Chad Hurley (co-founder of YouTube)

Jawed Karim (co-founder of YouTube)

Max Levchin (founder of Affirm)

Jeremy Stoppelman (founder of Yelp)

The PayPal Mafia has collectively built 11+ unicorns and $2.2T+ of market cap value.

This was the competition Mike and Steve were facing.

BidPay’s funding was just a $10,000 check Mike wrote to cover costs.

Mind you, this is while Mike’s working two jobs.

Didn’t matter.

“I’ll never forget one day Steve called me up. I was on my trading desk and he goes, ‘You’re not going to believe this. We have like 760 orders.’ Normally we’d have around 12. He’s like, ‘I think the buyers and sellers on eBay are starting to talk.’... We were amazed not just at the amount of orders, but literally overnight we were a global company. People were buying and selling in countries we’ve never heard of. It was an amazing feeling… It didn’t stop at 760 orders per day; it quickly got to thousands and just kept growing.”

Michael Capelli to mainstreet.

With the newfound demand, BidPay quickly grew from just Mike and Steve to roughly 8 employees. The startup found a bigger office as well.

New money brought new problems.

Word began to spread about what BidPay was doing.

eBay gave them a call.

“One day the phone rang and the person was asking a lot of questions about the business. So Steve told me, ‘Mike you take this, because as a sales-trader you’re used to talking to people and negotiating.’ I got on the phone and the person's asking a lot of questions. It turns out, she worked in the office of Meg Whitman, who was the CEO of eBay at the time. So we set up another call. They were interested in the company. We spoke to them about what we're doing, kind of opened the kimono, and then we waited for them to call back, and they never did. They never called back. Then they came out with a product, I think it was called Billpoint, which looked identical to BidPay, the website, everything. We learned a very valuable lesson. Be careful as to how much you divulge about your company, about the inner workings. We thought they were there to buy us and they were just there to get information on what we were doing.”

Michael Capelli to mainstreet.

Time flies, and the year is now 2000.

The dot-com bubble was starting to burst.

Competition got tougher each year.

eBay was showing no signs of slowing down with Billpoint.

That’s when Western Union came knocking on the door.

“We got a call from Western Union and they said, ‘Who the hell are you guys? You're our largest producer of Western Union money orders. What are you doing?’ It was a little bit of concern from them and we explained what we were doing and then they said, ‘We have a better way of doing this. We’re going to automate the process for you.’ So we worked with Western Union to create an automated method for payment… After some time, Western Union came to us with a number and said we want to buy you guys.”

Michael Capelli to mainstreet.

After all of the toil and tribulations, BidPay finally scored an acquisition offer.

All the more impressive considering they found product-market-fit without a single dollar of venture funding.

Plus, Mike never left his gig at ITG.

Both founders liked the number presented to them, and the job was finished.

In 2001, BidPay was acquired by First Data Corp, the parent company of Western Union.

Today, Michael Capelli is a co-founder at Level2, a fully visual no-code platform that allows anyone to build quantitative trading algorithms. He joined the company after Andrew Grevett and Shantanu Johri built the initial product. Andrew saw the vision, and Shantanu had the technical chops to bring it to life. Michael’s role was to refine the product using his experience trading statistical arbitrage at a hedge fund; he also developed a go-to-market strategy designed for sustainable growth.

He views the societal shift in retail trading today as an even larger opportunity than online payments in the late 1990’s.

U.S. retail investors now account for 20-25% of total U.S. equity trading volume, up from ~10% in 2010

Global robo-advisory assets under management has grown from ~$200B to $2T+ over the past decade

Retail investors still lack meaningful access to quantitative trading systems

Michael is capitalizing on the opportunity by building the Figma for quantitative trading algorithms - casual users can leverage visuals to construct robust algorithms, backtest, and deploy strategies for their personal portfolios efficiently.

Level2 is backed by Techstars and based in New York City.

You can connect with Michael Capelli on LinkedIn and stay up to date with Level2 on their site.