Andreessen Horowitz I.

a16z is the greatest venture capital firm in the world.

Today’s memo is brought to you by Caplight.

Caplight puts VC data and deal flow in one place.

The best venture investors in the world use Caplight to track private company valuations and fundraising activity, and to trade the private markets.

Book a demo here.

The only thing you need to know about Andreessen Horowitz is that the firm is ubiquitous when it comes to technology investing. America’s greatest venture capital firm occupies entire territories within the realm of innovation finance, and its single internal compass is to spread as far as the eyes can see. Andreessen Horowitz, also known as a16z, has created an unparalleled network of powerful investors, founders, and policymakers that intersect to create critical connections like the Via Appia in Brindisi.

Do not let semantics confuse your sensibilities.

a16z is not a venture firm, it is the Roman Empire of the innovation economy.

Most people are familiar with Marc Andreessen and Ben Horowitz. Jeff Jordan served as the President of PayPal and CEO of OpenTable before becoming a16z’s fifth general partner in 2011 and also leading their investment into Airbnb that same year. Brian Quintenz, CFTC Commissioner under President Trump from 2017-2021, joined a16z’s crypto team and was named Global Head of Policy at the firm. There’s Chris Lyons, the diversity champion responsible for launching the Cultural Leadership Fund, which links portfolio companies with black celebrities like Nas, Pharell, and Serena Williams; Lyons was promoted to general partnership in 2021. And Michele Korver, a former Department of Justice crypto enforcement leader with more than twenty five years of experience across the DOJ and Secret Service - she now serves as the Head of Regulatory at a16z crypto. There’s Katie Haun, an early a16z crypto investor who left to start her own multi-billion dollar operation, and Margit Wennmachers, a partner emeritus with a marketing background who helped build a16z’s media engine, and Andrew Chen, a general partner leading their emerging accelerator platform, a16z speedrun. These are just the usual suspects…

The fund’s boundless connectivity has transformed early stage technology investing from a risky endeavor to a predictable system, bridging the gap between incubating ideas and initial public offerings, simultaneously competing with accelerators like Y-Combinator, early stage funds like Union Square Ventures, and growth equity firms like Tiger Global, all while staffing a swanky office in D.C. with lobbyists to sway public policy in their favor. When a limited partner sits down for lunch with a16z, the menu looks more like Cheesecake Factory than Bobby Van’s. Endless options for any allocator: snack on pre-seed startups through the speedrun vehicle, get early exposure through the seed fund, have a bite of Series A companies through the core funds, but make sure to save room for the growth fund. The crypto fund is one of the largest in the land - rivaling crypto-centric firms like Paradigm and Polychain, the bio + health fund competes with Google Ventures and Lux Capital for scientifically inclined founders, and the American Dynamism fund is trying to wipe Peter Thiel’s Founders Fund off the map. It doesn’t matter which sector becomes hot next year, whether Democrats or Republicans or in office, or if artificial intelligence control alt deletes half the human race - a16z is built to win no matter who’s winning.

Start with speedrun, a program that was launched by a16z in 2023, with the purpose of eating Y-Combinator’s lunch. The twelve week immersion guarantees roughly $500,000 to $1,000,000 in funding from a16z’s speedrun fund plus access to hundreds of hungry investors at demo day, the end of program presentation. Speedrun invests using capital from Games Fund One ($600M) and Games Fund Two ($600M). As of 2025, the fund has deployed $180M+ into 150+ startups through the speedrun initiative, with a focus on repeat founders who have already built and sold successful companies prior to joining. The focus on seasoned founders, in addition to a bent towards consumer, gaming, and AI sectors, marks speedrun as separate from Y-Combinator, which is generally more open to first time founders and has larger batch sizes. Speedrun’s last cohort selected 60 companies from 14,000 applicants.

Lekondo is building the discovery engine for fashion.

Ursa is making autonomous mines a reality.

Atrios will pay you thousands of dollars to connect companies to decision makers.

Axon is building DeepMind for finance.

Rork is Lovable for mobile apps.

Agent Astra is building an AI-powered UPS.

The founders have impressive backgrounds as well.

Levan Kvirkvelia, co-founder of Rork, built a mobile app with 2 million users at 17 years old in Russia.

Nick D’Aloisio, co-founder of Axon, previously founded and sold two companies, one to Twitter and one to Yahoo, and raised $31M+ in venture funding from Index Ventures, Mike Moritz, Jared Kushner, and Brian Chesky.

Taylor Offer, co-founder of Atrios, scaled Feat Clothing to 100+ employees and $50M+ in revenue before selling the company to private equity.

We sat down with Taylor to talk about why an entrepreneur with a resume like his was interested in the a16z speedrun program.

His answer was both candid and concise: “When you get a chance to be in the room with anyone who is the best in the world at what they do, you go into that room. a16z are world class investors and operators.”

From Taylor’s perspective, the accelerator was much more hands-on than anything else on the market. Well known a16z heavyweights took hours out of their day to roll their sleeves up and help Taylor move Atrios from 0 to 1.

"Tom/Jordan/Jordan/Bella on the recruiting team helped us hire five full time engineers and product people, from Google DeepMind, Harvard, Waterloo and Amazon.

Andrew Lee and Josh Lu helped us raise $3.5M.

Sam Shank, Andrew Chen and Fareed Mosavat changed the way we think about our product.

Troy Kirwin helped us think through strategic decisions.

Macy Mills helped us go to market by setting up meetings with Stripe, Open AI and many more.

I learned so much and I am so grateful for their team.”

Taylor Offer, Atrios founder and CEO, to mainstreet.

According to Taylor, within 12 weeks, speedrun took Atrios from $0M in run rate to $1M, from just Taylor working on it to a team of seven, and from no investor interest to over 250 inbound investors eager to join the cap table. The next item on his agenda is to transform the sales operating playbook from low conversion cold emails to warm introductions driven by people-first relationships.

Given speedrun’s infancy relative to established accelerators, it’s difficult to determine whether or not efforts have been successful in generating unicorns. Just two years in, there are some promising candidates that are showing flashes of potential.

One of those companies is Fundamental Research Labs, formerly known as Altera. Altera went through a16z speedrun in early 2024, raising funding with the goal of building AI agents that play Minecraft with you. The startup was led by an assistant professor at MIT’s MetaConscious Lab - Dr. Robert Yang - and his fellow researchers - Andrew Ahn, Nico Christie, and Shuying Luo. They raised a $9M seed round from First Spark Ventures (Eric Schmidt’s fund) and Patron with participation from Benchmark partner Mitch Lasky, Alumni Ventures, a16z speedrun, and others. On May 27, 2025, the startup rebranded to Fundamental Research Labs, an intentional name which reflects the unusual company structure. Fundamental Research Labs almost mirrors the early version of OpenAI by building multiple AI products in different fields, using research to lead the innovation process. Organizationally, the company has a team focused on games, a team focused on prosumer apps, a core research team, and a platform team. One of their more recent launches, Shortcut, gained traction after a semi-viral launch on Twitter and LinkedIn. Shortcut is a “superhuman Microsoft Excel agent” that beats first year analysts from McKinsey/Goldman head-to-head 89.1% of the time (220 - 27) when blindly judged by their managers. According to the launch post by co-founder Nico Christie, the company gave human analysts 10x more time to complete the tasks. On the back of the Shortcut breakthrough, Fundamental Research Labs scooped up a $33M Series A from Prosus in August 2025, giving a16z speedrun a sweet mark-up along the way.

But why start speedrun? It’s not like these guys need the cash that comes with pre-seed investing. Take Fundamental Research Labs for instance: a16z speedrun invested $500,000 for 10% of the company, standard terms, and they invested more into the seed round; the fund probably saw a 25 - 40x markup after a Series A of that magnitude, depending on valuation and other factors. Turning $500,000 to $15,000,000 a couple of times doesn’t mean much for a $46B firm. Even a 200x IPO probably wouldn’t persuade Horowitz to giddily pop a bottle of Perignon. Speedrun is not about capital creation for the a16z platform, it’s about vertical integration. This is an attempt to monopolize further. a16z already has the ability to raise $10B funds to invest in startups from seed all the way to Series P or whatever letter startups are stretching to nowadays; a pre-seed accelerator is the last infinity stone on the venture spectrum. Speedrun gives the platform another dealflow engine to power investments upstream, and by backing founders early, the company has a competitive advantage in the larger later rounds that count more for a firm of their size. The sector focus is also intentional: consumer and gaming are highly visible businesses with a virality component, meaning everyone knows what Snapchat and Fortnite are but not everyone understands why Databricks is a valuable business. If a16z speedrun can be the first check into a few generational consumer/gaming businesses, then they create a real Y-Combinator competitor with a unique cultural identity that will be a very valuable outpost in the near future.

Rome wasn’t built in a day.

Around 753 BC, a collection of huts on the Palatine Hill with a pastoral, agricultural economy was the precedent. To the north were the Etruscans and to the south were the Greeks. The first major military victory did not take place until 585 BC when the Romans captured the town of Apiolae. This victory was led by Lucius Tarquinius Priscus, and the post-game celebration - a bloody plundering of Apiolae - was led by Priscus as well. Such was the tradition: victors were expected to show no mercy to the victims, and defeat meant total defeat, every man was to die, every woman and child was to be enslaved, every valuable resource stolen and consumed by the champions who deserved it. It was not a regional tradition, either, this was the universal law among the nations that needed no official ratification. Almost every military leader from the different villages around the world co-signed. Innovation has a funny way of introducing itself, however; rarely does it knock at the door like a polite neighbor, rather, you see flashes of it streaking through the dark every fortnight and just when you forget about it weeks later, it’s in your kitchen at seven in the morning reading a newspaper. In 338 BC, Romans squashed their Latin allies in a quick fistfight, but instead of burning and looting the conquered towns, the Romans made a decision that changed the course of history itself. After winning the Latin War, Rome gave citizenship to the Latin cities and integrated them into the Roman empire. Civitas sine suffragio, or limited citizenship, was the innovative concept that turned Rome from a hut village to the largest empire of all time. Every win was now more than a win, it was an opportunity to turn neighbors into family. Over time, the conquered territories would adopt elements of Roman culture, send their strongest soldiers to fight for Roman expansion, and even have homegrown political leaders represent their interests in Rome’s Senate. From 280 BC to 275 BC, Rome fought Pyrrhus of Epirus, a feared military general, and his Greek allies. Pyrrhus was not just a skilled killer, he was viewed by Greeks as the best thing since Alexander the Great (Pyrrhus was actually distantly related to Alexander). The first battle was a decisive beating in favor of Pyrrhus and the Greeks. While Pyrrhus was waiting on the Romans to send a peace treaty in response to defeat, the Romans went to one of their conquered Latin cities and raised another army of men at a moment’s notice. Pyrrhus delivered yet another smackdown, using a gang of fighting elephants to stomp out every Roman body in sight. The Romans went to yet another Latin city and raised another army. When Pyrrhus saw the third army spawn out of thin air, he realized he could not afford to win another battle against the Romans, so he retreated back to the safety of his quarters. He would later compare the Romans to a hydra, the mythical dragon-like monster with multiple heads and the ability to grow two new heads for every one that was severed. This is how the Romans won the Pyrrhic War without winning a single battle, and this is how the term Pyrrhic victory came into existence.

Venture capital, from its infancy, was largely isolated from the founders it funded. Financiers did not mingle with the founders they backed; the most powerful venture funds maintained largely paternalistic relationships with their portfolio company founders, unafraid to swiftly replace them with outside CEO hires or enforce strict governance. Founders were viewed as children meant to be disciplined and held accountable, and venture capitalists were the adults in the room. The norm was to replace a founder with a “real CEO” before an IPO, and exited founders would be cast out of the kingdom. In the early 2000’s, there was a shift, and successful founders started to recycle their capital back into the tech investing ecosystem - guys like Jeff Bezos, Reid Hoffman, and Jerry Yang started to invest their riches into upstart projects in Silicon Valley, and the line between founder and investor became slightly blurry. But it was really Andreessen Horowitz that completely shifted the energy from “we need to babysit founders” to “founders are heroes”. Both Marc Andreessen and Ben Horowitz were founders before becoming investors, and they carried that with them into the arena of venture capital. While other venture firms remained relatively closed off, operating behind locked doors and maintaining small, elite partnerships, Andreessen Horowitz opened citizenship up to founders. In 2013, a16z made Balaji Srinivasan, a biotech founder backed by Founders Fund, the firm’s youngest partner. Jesse Walden was the co-founder of MediaChain, an a16z backed startup that sold to Spotify, and he became a partner on a16z’s first crypto fund. Chris Dixon was a former founder at SiteAdvisor and Hunch before joining a16z and eventually becoming a general partner. Of course, other firms had hired founders as investors before, but not systematically and definitely not frequently. a16z made hiring founders a part of their DNA - it was an internal requirement that partner candidates had experience as a founder or early executive. The firm also launched a program that gave select founders the ability to invest in other startups as an a16z scout, with the rationale that good founders are able to spot other good founders on the ground and bring in under the radar dealflow. This is their civitas sine suffragio: do not just colonize the cap table; help the founder learn how to be an executive, empower the founder, and when the battle is over, grant the founder citizenship as a member of the platform team, a scout, or even investment partner.

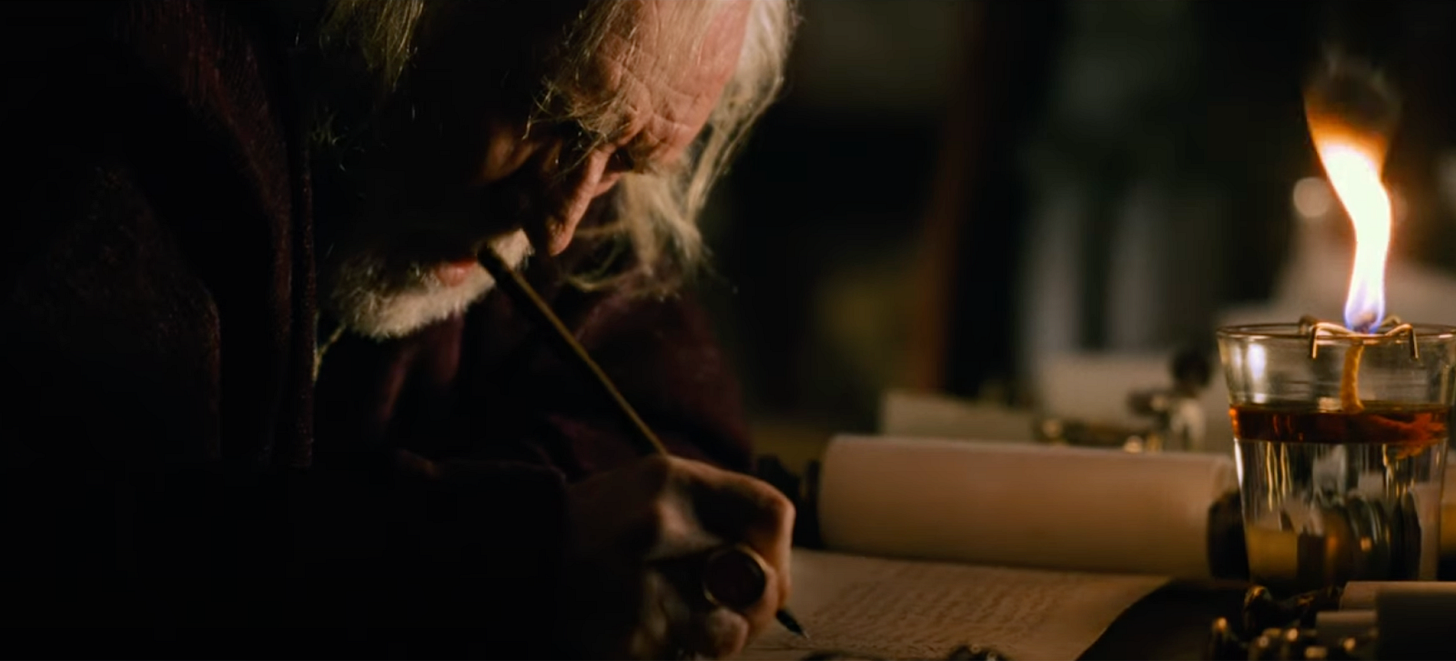

Marcus Aurelius furrowed his brow and hunched over his desk as he furiously scribbled thoughts onto parchment. Maximus stood to his left, anxiously waiting for the Roman emperor to acknowledge his presence.

MAXIMUS: Caesar?

AURELIUS: Tell me again, Maximus. Why are we here?

MAXIMUS: For the glory of the empire, sir.

AURELIUS: Yes. Yes I remember… Do you see that map, Maximus? That is the world which I created. For twenty five years, I have conquered, split blood, expanded the empire. Since I became Caesar, I’ve known four years without war. Four years of peace in twenty, and for what? I brought the sword, nothing more.

Marcus Aurelius is now on his feet as he questions the very mission Maximus’s fellow soldiers gave their lives to. The ruler and the soldier walk over to a couch to continue their conversation.

AURELIUS: Let us talk together now, very simply, as men. Well, Maximus, talk.

MAXIMUS: Five thousand of my men are out there in the freezing mud. Three thousand of them are bloodied and cleaved. Two thousand will never leave this place. I will not believe that they fought and died for nothing.

AURELIUS: And what would you believe?

MAXIMUS: They fought for you, and for Rome!

AURELIUS: And what is Rome, Maximus?

MAXIMUS: I’ve seen much of the rest of the world. It is brutal and cruel and dark. Rome is the light.

AURELIUS: Yet you have never been there. You have not seen what it has become. I am dying, Maximus. When a man sees his end, he wants to know there was some purpose to his life. How will the world speak my name in years to come? Will I be known as the philosopher? The warrior? The tyrant? Or will I be the emperor who gave Rome back her true self? There was once a dream that was Rome. You could only whisper it. Anything more than a whisper and it would vanish, it was so fragile. And I fear that it will not survive the winter.

What is Rome?

Marcus Aurelius’s question is heavy with the exhaustion of a victor who won a thousand battles yet lost his heart. Like an amnesiac climber who scaled insurmountable heights only to reach the apex and forget why he wanted to stand on mountaintops in the first place. Without guiding principles in place, any man, family, or nation will be deracinated and dragged off into the abyss when the raging winds of adversity sweep through searching for unmoored bodies. Even Rome was not exempt.

Marc Andreessen’s guiding principle for a16z is techno-optimism.

On August 20, 2011, he published an essay - perhaps manifesto is the more appropriate designation - titled “Why Software Is Eating the World”. In a 2,000 word effort, Marc vehemently defends the high prices of software businesses and articulates a clear argument as to why this is just the beginning. He uses several examples of physical industries that became software industries: Borders vs. Amazon (bookstores), Blockbuster vs. Netflix (video rental), CD stores vs. Spotify/iTunes (music). The Internet removed gatekeepers and provided a globalized distribution platform to accelerate entrepreneurial ventures. Non-technology companies would need to become technology companies in order to survive the winter.

In the future, every company will become a software company.

The essay became not only a16z’s guiding principle, but Silicon Valley’s North Star. As time went on, Andreessen’s predictions materialized and the firm’s status grew accordingly.

In hindsight, “Why Software is Eating the World” was just a precursor to the true impetus for expansion.

“It’s Time to Build” and “The Techno-Optimist Manifesto” are a16z’s core texts.

The former arrived at the peak of the coronavirus pandemic - April 18, 2020 - and was ridiculed for its insensitivity to the moment. Lives are being lost to disease and Marc Andreessen is saying we need to get back to coding software? But I urge you to hold your chariot and hear his argument in full. Andreessen uses the pandemic as a wake-up call to the reality that America has fallen behind on “building” hard but useful technologies, institutions, and edifices. Why don’t we have more houses? More skyscrapers? Better education systems? Alien dreadnoughts? An alien dreadnought is a term coined by Elon Musk to describe a futuristic factory that is so automated with robots that it resembles an extraterrestrial warship. Nuclear reactors? Flying cars? After berating the general populace for irredeemable laziness, Andreessen delivers a final call to action: “every step of the way, to everyone around us, we should be asking the question, what are you building?”

The Techno-Optimist Manifesto picks up where Time to Build left off.

Marc coronates technology as “the glory of human ambition and achievement, the spearhead of progress and the realization of our potential.”

We believe this is the story of the material development of our civilization; this is why we are not still living in mud huts, eking out a meager survival and waiting for nature to kill us.

We believe this is why our descendants will live in the stars.

We believe that there is no material problem – whether created by nature or by technology – that cannot be solved with more technology.”

Marc Andreessen, The Techno-Optimist Manifesto

I believe that techno-optimism is at the heart of the a16z empire. It’s the reason some of their founders are willing to spend years of their prime building just to watch their startups die after a16z decides to pass on the next funding round - those years given to the game are sacrificial offerings to keep the techno-optimist machine energized. Techno-optimism is the reason that occupying a thousand cap tables is not enough; if Rome conquers the world, the next project is to build intergalactic hotels and take the moon. Mars. Jupiter.

More technology.

More funds.

More.

This is the dream that is a16z.

a16z’s wins are hard to count.

The firm has returned $25B+ to their limited partners since 2009, a number that very few venture funds will come close to matching. They’ve most recently raised $10B in new funds, adding more muscle to what was $60B+ assets under management. They’ve backed the most unicorns (startups valued at over $1B) of any venture capital firm since 2020, with the next closest competitor being Sequoia Capital. Slack, Roblox, Figma, Lyft, Pinterest, Airbnb, Stripe, Databricks, Skype, Github, Facebook, Coinbase, Okta, Oculus, Instagram, the list only ends if you say when. The investment in Okta generated ~$2B in cash returns, the investment in Coinbase generated $11B, Airbnb brought in ~$3.5B - $4B depending on exit timing post-IPO, Slack made $3B for a16z, Roblox brought in roughly $1B, Pinterest around $1.5B, Lyft generated ~$1B… The big winner that accounts for more than a third of their total returns is Coinbase, which explains the firm’s soft spot for cryptocurrency.

It is important to understand that if a16z writes a ten million dollar check and it goes to zero none of that matters for their bottom line. As a matter of fact, you can probably multiply that number by ten and the techno-optimists wouldn’t lose more than ten minutes of ambien-induced sleep.

The only wrongdoing that cannot be forgiven in a16z’s utopia is missing out on a winner.

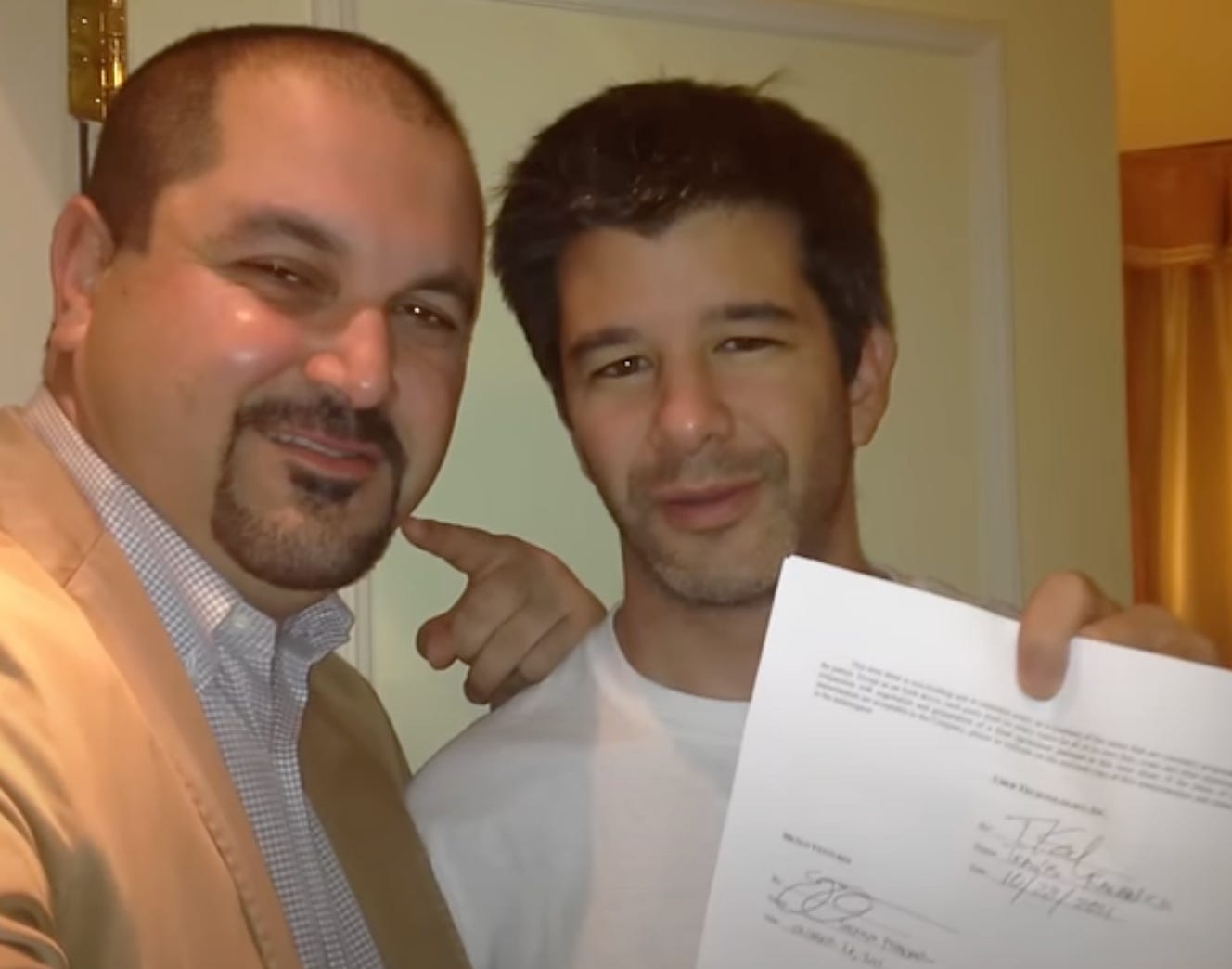

Jeff Jordan had the hot hand in 2011. The a16z general partner just closed a deal to invest $27M into Pinterest, one of the hottest social media startups at the time. With the new investment, Jordan joined Pinterest’s board of directors in October. A few months prior, in July, Jordan helped a16z lead Airbnb’s $112M Series B alongside DST and General Catalyst. There’s no other way to put it, Jeff was on a generational run, he secured investments into two extremely hot companies that would go on to become great investments for the firm. And he did it over the course of a three month period, which is, in venture capital timeframes, a few days. The next deal in the pipeline for him was Uber’s Series B. Travis Kalanick, Jeff Jordan, and Marc Andreessen agreed that a16z would lead this round at a valuation slightly higher than $300M. Pinterest, Airbnb, and Uber all in the same year. Incredible. Shervin Pishevar also had a hot hand. The former founder was recruited to Menlo Ventures after one of his mentors, Sheryl Sandberg, emailed several top funds saying they should hire Shervin. Shervin joined Menlo in the summer of 2011 and closed investments into Warby Parker, Tumblr, and Machine Zone during his first 90 days in office. He had been trying to meet with Travis Kalanick to discuss an Uber investment for over a year, and Kalanick was being difficult. So Shervin tapped every node of his network to apply pressure: Sheryl Sandberg told Kalanick to meet with Shervin, Drew Houston, founder of Dropbox, reached out as well, Naval Ravikant sent him a message. Finally, in August 2011, Shervin was invited to meet Travis at the Uber office to discuss their upcoming Series B round. The two talked for hours and had a good time. Some time after that meeting, Kalanick called Shervin on the phone and let him know that they would be going with another firm - which turned out to be Andreessen Horowitz. Shervin let him know that if the deal fell through, Menlo was still interested.

A few weeks later, Shervin Pishevar was in Algeria giving a keynote speech for Obama’s Entrepreneurship Summit. It was during this time that he got a call from an unknown number, and something told him to answer the call, which turned out to be Travis Kalanick. Kalanick told him to meet in Dublin, Ireland. Tomorrow. Shervin hopped from Algeria to Dublin and had a pint with Travis. This is when Travis told him the true vision for Uber: replace car ownership completely. Pishevar was giddy. The question everyone should be asking is, why did Travis call Pishevar from an unknown number to meet in Dublin? Right as the a16z-led Uber Series B was closing, Marc Andreessen invited Travis Kalanick to dinner and told him they still wanted to do the deal, but they could only afford a $220M post-money valuation for the company, not the previously agreed upon $300M+ price. Kalanick felt like this was a classic investor power move, waiting until the deal was virtually done before squeezing a little more juice out for themselves at the finish line when everyone was already emotionally committed. Nonetheless, Kalanick decided to forgive the transgression and find a way to put ink to paper. Then, the a16z term sheet arrived. In the term sheet, a16z included a large “new option pool refresh” in the fine print, which would increase the amount of stock options available for new hires, but in the same vein, dilute existing shareholders’ equity value, including previous investors and founders. Travis wasn’t going for it. That’s why he called Shervin Pishevar to meet in Dublin.

After their conversation, Shervin went back to his hotel and put a term sheet together at $290M post-money, then texted it to Travis for validation.

Travis didn’t answer.

Shervin got nervous, and he texted Travis, “$300M?”.

Travis texted back and said $290M is fine.

Shervin ran to Travis’s hotel room, Travis signed the term sheet, and they took a picture to celebrate.

Menlo Ventures stole the deal of the year - and probably the decade - because Andreessen Horowitz got cold feet.

Menlo would lead the $32M round at a $290M valuation alongside Jeff Bezos and Goldman Sachs.

Andreessen Horowitz would go on to invest in Uber competitor, Lyft, and owned 6% at the time of Lyft’s IPO.

All in all, a16z’s fumble cost them at least a few billion dollars in returns.

Where do we go from here.

The obvious answer is an initial public offering for a16z.

No other great American venture firm is publicly traded yet, so going public would be a permanent stamp of approval for the megafund. We can look back to Blackstone as an example of the importance of being first.

On June 21, 2007, Blackstone went public, selling a 12.3% stake in the company for $4.13B, a valuation of $33.58B, in what was the largest IPO since 2002. Blackstone’s stock was off to a bumpy start for the first ten years of trading, but the past five years have been fruitful: 245% gain compared to the S&P 500’s 100% gain. Overall, the stock is up 413% since going public. Blackstone’s market cap is now $208B, a larger market cap than BlackRock ($175B) despite managing a fraction of assets relative to BlackRock. BlackRock - $10T AUM, Blackstone - $1T. The market likes Blackstone more because the management fee revenues are significantly larger, and the carried interest is substantial as well, whereas many of BlackRock’s assets are in low fee index funds which don’t generate the same revenue outcomes.

KKR went public shortly after Blackstone in 2010. Market conditions led to somewhat of a delay for the firm, because Blackstone’s stock performed poorly in the years following their IPO. Their stock followed a similar trend as Blackstone’s; mediocre performance for the first ten years, then a steep uptick in the last five. KKR’s stock is up 305% in the last five years, far outpacing the S&P 500’s 100% gain, and overall the stock is up 1,318% since listing in 2010. This means an LP is likely better off having bought KKR stock than investing in fragmented funds with varied performance, considering the 13x gain over a 15 year period. Nonetheless, hindsight is 20/20. KKR manages roughly $700B, and has a $121B market cap.

Apollo went public in 2011, shortly after KKR did. As you can predict by now, the stock saw sharp growth in the past five years, as the market developed a strong taste for large private equity managers. Apollo experienced 204% gain over the past five years, more than doubling the S&P 500’s growth. Since the IPO, Apollo’s stock has gone up 656%. The company’s market cap is $82B and it manages $512B.

Other publicly traded American private equity managers include Carlyle - $465B AUM / $23B market cap, Ares Management - $378B AUM / $54B market cap, and TPG - $221B AUM / $22B market cap.

In aggregate, six American private equity funds are public, and they account for more than $500B in market cap and more than $3T AUM.

I say this to highlight the extraordinary success that private equity managers have had in scaling their businesses to the largest fund sizes and IPOs, while venture capitalists have not been blessed with the same fortune. Part of this is intrinsic to the differences between the two related yet distinct asset classes. Leveraged buyouts (private equity) are buying and selling whole companies that are already established and in some cases, public companies. These are large, blockbuster transactions that require intensive amounts of capital, both in cash and debt. On the other hand, venture capitalists are investing in a range of early stage companies, ranging from entrepreneurs with nothing more than an idea and initial prototype (pre-seed) all the way up to rapidly scaling technology ventures that are producing billions of dollars in revenue at the Series D+ stage. Venture capital requires less money. An IPO, therefore, makes less sense to funds, as they can continue to raise large venture funds without heightened regulatory scrutiny. A few funds - including a16z - will likely go public in the near future as they scale into the $100B+ range and founders/key personnel look for a large payout.

From a product perspective, there is still plenty of room for a16z to explore to enhance their potential public market valuation. The first opportunity, ironically, is public markets. If artificial intelligence is nearly as disruptive as Silicon Valley insiders are claiming it to be, the value distribution in public companies will be disrupted in the next decades. Who else could more clearly construct portfolios, take advantage of mispricings, generate alpha in a post-AGI world, and institutionalize a deep tech hedge fund than a16z? There are definitely multiple players who could beat the firm at one or two of those tasks, but holistically, Andreessen Horowitz is as well positioned as anyone to deploy capital at scale and bridge insights from their early stage portfolio to find lucrative plays in equity markets and other both liquid and illiquid markets. At the very least, doing so has the near term potential to add anywhere from $30M - $100M+ in annual recurring revenue through management fees, albeit that revenue would be less sticky than venture capital management fees assuming limited partners are able to withdraw funds on a periodical basis. If a16z were to launch a hedge fund, they might want to give Leopold Aschenbrenner a call. The 23 year old AI researcher launched a $1.5B hedge fund named Situational Awareness LP after getting fired from OpenAI. The fund was built to invest in primarily public markets with the underlying thesis that AI will completely reshape which public companies thrive over the next decade, and it takes an AI insider to understand how to exploit such a broad opportunity. Leopold’s story is quite interesting: he was a valedictorian at Columbia University at just nineteen years old before going on to work at FTX’s philanthropy arm under Sam Bankman-Fried. He then worked at OpenAI for roughly a year, where employees saw him as arrogant. According to a Fortune article, multiple employees claimed that at a company party, Leopold casually told then Scale AI CEO Alexandr Wang how many GPUs OpenAI had, a violation of company privacy. Leopold was fired for a separate incident in which the company claims he leaked internal information. That was April 2024. Two months later, Leopold published a 165 page essay titled “Situational Awareness: The Decade Ahead” and laid out a future of what a post artificial general intelligence (the one size fits all phrase for AI that can truly think like humans, or better than humans) world would look like, and why no one is ready for it. The manifesto went viral within a certain corner of the Internet, and even Ivanka Trump had good things to say about it. On the back of that momentum, Leopold raised $1.5B from endowments, family offices, Patrick and John Collison (Stripe founders), Daniel Gross, and Nat Friedman. Through the first half of 2025, Situational Awareness LP is up 47% after placing a well timed call option on Intel before the U.S. government announced their strategic partnership. If a16z wanted to pursue this pathway, clear guardrails would need to be established in order to prevent the cannibalization of their existing venture capital business. From a regulatory perspective, the firm is already set up to handle this given their shift to a Registered Investment Advisor model in 2019.

Another opportunity can be found in private credit. Private credit is a form of lending outside of the traditional banking system, in which lenders work directly with borrowers to negotiate and originate privately held loans that are not traded in public markets. Following the Global Financial Crisis (GFC) in 2008, and the associated capital rules for banks, private credit has filled a lending void. Private credit includes direct lending, special situations, asset based finance, distressed debt, and preferred equity, to name a few. The global private credit market has roughly tripled in size over the past five years, growing from $1T in 2020 to $3T today. The specific subsector that a16z is well suited to compete in is venture/growth private credit, asset based financing for capital intensive tech companies and infrastructure. Apollo and 8VC announced a partnership to do just this earlier this quarter, forming a joint venture to deploy several billion dollars with a focus on funding the American Industrial Revolution through flexible capital solutions.

These are just a few low hanging ideas for growth. As it stands today, a16z could be an intriguing public company with a lot of long term upside. Earlier in February this year, Marc Andreessen made an appearance on the Invest like the Best podcast and said he isn’t chomping at the bit to take the firm public. In the same discussion, however, he talked about his goal to make a16z a long lasting firm more akin to J.P. Morgan or Goldman Sachs than a traditional venture partnership that fails to outlive its founders. He cited other public investment companies as well, Blackstone, KKR, Apollo, as good examples of investment franchises that scaled with grace. Reading between the lines, it sounds like Andreessen will take the firm public at some point in the next five years.

The sun never sets on the a16z empire.

Maybe that’s a good thing.