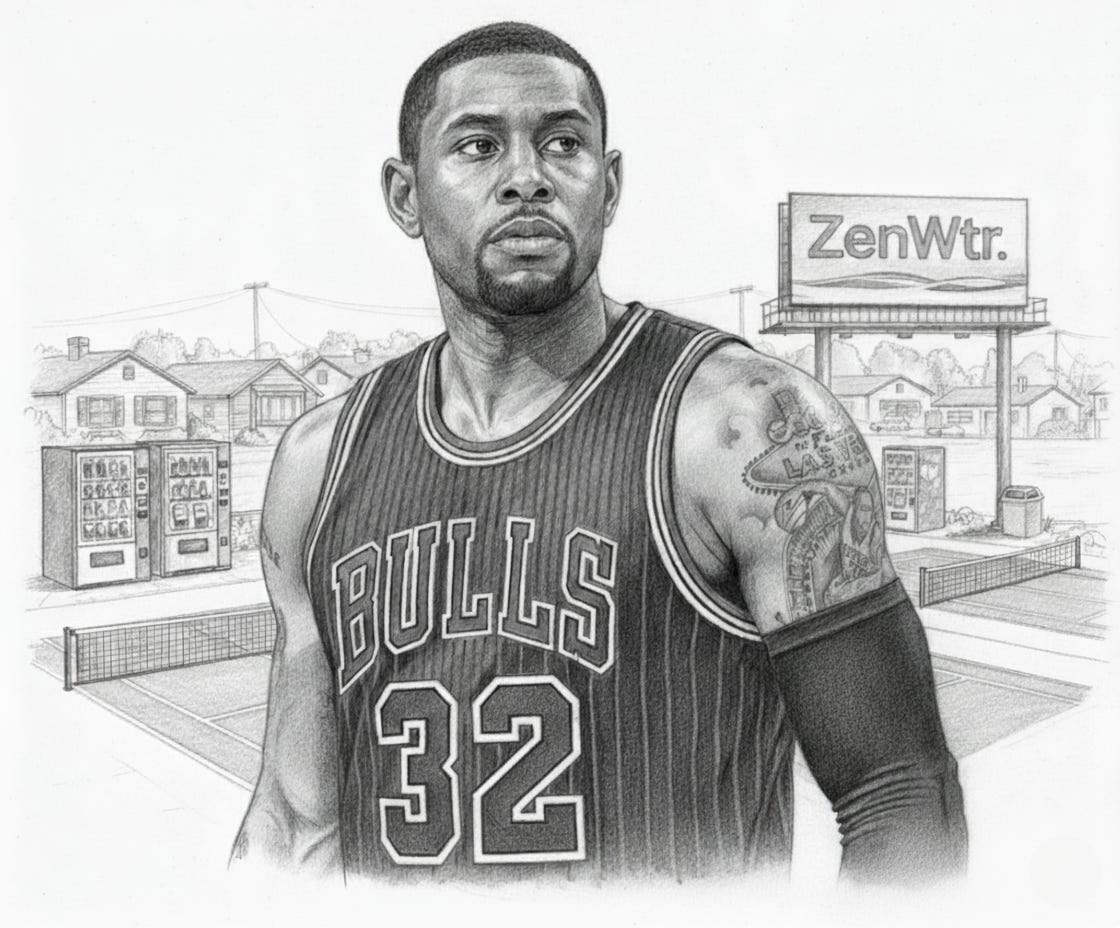

Is C.J. Watson Building a Modern Day Berkshire Hathaway?

Inside the former NBA guard’s journey to building a portfolio that spans venture capital, real estate, vending machines, and sports franchises.

C.J. Watson earned millions during his decade-long NBA career. (Not bad for someone who went undrafted.)

But what he’s doing off the court is even more impressive.

Ask him what he’s doing these days and he’ll respond in classic C.J. fashion: “Just learning about different things, you know?”

What most people don’t know? He’s quietly building one of sports’ most unique investment portfolios - one that reads like a masterclass in diversification: rental properties, vending machines, startups, and even a stake in Major League Pickleball.

On the surface, it looks completely random. But if you dig deeper, it’s pure strategy.

The Undrafted Disadvantage

“It’s not about the cards you are dealt, but how you play the hand you’ve got.”

People always say: pick one thing, go deep, and master it. Don’t be a jack of all trades.

C.J. did the opposite, and it became his superpower.

It all started twenty years ago on draft night. While lottery picks celebrated with champagne and team jerseys, C.J. watched from his couch as all 60 picks came and went. No phone call. No guaranteed contract. No clear path forward.

The disappointment was a wake up call. As an undrafted rookie, he had no choice but to diversify his career and prepare for life beyond basketball from day one.

“I was undrafted and I didn’t know if I was ever going to make it to the league,” he reveals. “And even while I was playing, I was always planning for an exit not knowing when an exit would come.”

You can’t put all your eggs in one basket when you’ve never had a guaranteed basket to begin with.

Today, that same philosophy drives everything he does off the court.

“Diversification is key to building generational wealth.”

C.J. approaches investing the same way a coach builds a championship roster. To win a championship, you need reliable scorers, defensive stoppers, and role players who fill the gaps. Investing works the same way - different assets play different roles.

In his portfolio, rental properties and vending machines generate predictable cash flow. Startups and sports franchises? Those are the moonshots - investments with unlimited potential upside that could generate tens or hundreds of millions a decade from now.

But C.J. isn’t throwing darts in the dark. He’s now applying the hard-earned wisdom from a decade of competing in the world’s toughest basketball league to the world of investing.

Knowing His Strengths

The first lesson C.J. brought from the NBA to investing? Know thyself.

“I was never elite at just one thing,” he explains. “I was pretty good at a lot of things. So that’s what I prided myself on as a player, and it’s the same way I invest.”

Ten years in the NBA proved the value of being a generalist. He was never the tallest, fastest, or flashiest player on the court. What kept him on the court was something subtler: he could do a bit of everything. Initiate fast breaks. Shoot the three. Lock down the perimeter. Set screens. Whatever it took.

C.J.’s investing philosophy mirrors his playing style. He explores broadly, experiments quickly, and builds depth across multiple areas. His goal isn’t to chase everything - it’s to test, learn, and double down where his curiosity aligns with his strengths.

It doesn’t matter the asset class, he’s willing to dive in. He knows he has the capacity to learn quickly, and that doing so helps him increase his surface area of luck. (Because let’s be honest, everyone needs a little luck.)

But he also knows when to step back from opportunities that don’t fit.

Take real estate. Like many retired athletes, C.J. tried it. On paper, rental properties were perfect: steady cash flow, tax perks, and a set-and-forget system that builds equity while tenants pay down the mortgage.

But in practice? It wasn’t as passive as he thought. After buying a few single-family homes, he realized, “I just didn’t like being a landlord. Having to go to my properties and change the filters and handle all the day-to-day stuff. I thought I would like it at first, but then I didn’t.”

C.J.’s experience in real estate taught him a lesson that complements Warren Buffett’s famous rule of only investing in what you understand: only invest in what fits who you are. Even as a generalist, he chooses his shots wisely, staying selective and disciplined with every investment he makes.

Rather than forcing himself to invest in something he isn’t good at, he has pivoted his real estate strategy entirely. Today, he favors triple net leases - a much more hands-off approach that removes the landlord headaches while still capturing the upside of real estate.

Mastering the Fundamentals

Every NBA coach preaches the same gospel: master the fundamentals before you get fancy.

C.J. took that to heart. He wasn’t the type to chase highlight-reel plays. He focused on the fundamentals - the unglamorous, repeatable skills that may not always show up on the stat sheet.

Vending machines are his way of getting the basics down.

“Me and my wife were looking for another income stream,” he explains. “We thought it could be beneficial for us to learn how to become business owners, to become entrepreneurs.”

The concept is simple: buy low, sell high, identify high-traffic spots, and let the machines do the work.

Some investors might dismiss vending machines as trivial or too small to matter. C.J. sees them differently. For him, it’s a low-risk way to practice the fundamentals:

Unit economics? Check. Every sale generates a 1500% markup. “When you can buy water for twenty five cents at Costco and sell it for three or four dollars, the margins are good.”

Scalability? Check. Once optimized, the machines practically run themselves. “Some places are open 24 hours and have lots of foot traffic. So I’m making money while I’m sleeping.”

Predictability? Check. Unlike real estate or startups, vending machines generate immediate, measurable returns. “I don’t need to wait years to get my money back.”

But vending machines were never the end game. It gave him skin in the game and a chance to sharpen his instincts as an investor. Mastering the basics on a small scale taught him lessons he now applies to higher-stakes investments.

Now, with three machines quietly generating revenue in animal hospitals and city hall, he gets to decide if and when he wants to scale.

Building a Support System

C.J. credits much of his success, from going undrafted to reaching the NBA to now building his investing portfolio, to the network of people he surrounds himself with. He treats every interaction, whether with a coach, teammate, equipment staff, or even a newsletter writer, like a session with his personal board of directors.

“You have to be a sponge. Working with people who know more than you will push you to ask better questions and see angles you wouldn’t have seen on your own.”

When C.J. decided to step into venture capital, he knew he had to learn from people who have been there and done that. That’s when he met Rashaun Williams, a veteran investor who co-founded a VC firm with rapper Nas and backed startups like Robinhood, Coinbase, Ring, Lyft, and Dropbox.

Rashaun didn’t just teach C.J. the mechanics of investing in startups - he taught him how to think like an investor building generational wealth. “He gave me books, ran masterclasses on Zoom… that’s how I first got started,” C.J. recalls. Through Rashaun, he learned to target 10-15X returns and evaluate startups the way seasoned VC investors do.

Over time, C.J. has expanded his support system, joining networks like the Pro Athlete Community and co-investing with top-tier VC firms like Tribe Capital. Along the way, he discovered a simple truth about venture capital: early-stage startups offer massive upside but carry high risk, while later-stage deals are more predictable but offer smaller returns. But he learned something even more fundamental. “Great companies, like great teams, succeed because of the people,” he says. Like Warren Buffett, C.J. bets on people and patience more than hype. No matter the stage, his evaluation always begins and ends with the founders, their teams, and the culture they’re building.

Today, his portfolio includes 32 startups (yes, you read that right), with investments in startups like ZenWTR, Therabody, Blackbuck, Shiprocket, and Khatabook, all showing early signs of becoming leaders in their respective industries.

Anticipating the Next Play

As a point guard, C.J. learned the importance of thinking many steps ahead - seeing where defenders would rotate, anticipating where his teammates would be, and setting up open looks before anyone else saw them coming.

While most people were still asking “What’s pickleball?”, C.J. was already buying in. “I honestly didn’t see myself as a pickleball investor,” he admits. “But when the opportunity came, it was a no-brainer to take a chance on it.”

He realized that the sport was gaining traction at the grassroots level. Courts were sprouting up in neighborhood parks and retirement communities. Pickup games became block parties, and leagues formed in schools and community centers. And soon, celebrities and athletes were picking up paddles, bringing even more attention to the fastest-growing sport in America.

But the appeal wasn’t just the sport’s growth - it was about the opportunity to get in early. He understood what every seasoned investor knows: timing is key. Buy into an NBA team today, and he’d be paying a premium price for a mature asset. Buy into an MLP team in 2023? He’d be betting on a “startup” with exponential upside.

C.J. recognized the same potential that drive successful sports leagues: ticket sales, media rights deals, merchandise opportunities, and real estate development around venues. If pickleball could capture even a fraction of tennis’s audience, early investors like him would see massive returns.

Turns out, court vision doesn’t just disappear when you retire, and it sure doesn’t apply to just basketball. For C.J., it’s a skill he’s brought to investing, and it’s now helping him spot investment opportunities long before they become conventional wisdom.

Looking Ahead

In basketball, C.J. was never the star that captured headlines. In investing, he’s not trying to be either. He doesn’t post screenshots of his portfolio on social media. He doesn’t boast about his most successful investments in interviews. And he definitely doesn’t make bold proclamations about becoming the next Warren Buffett.

The comparison to Berkshire Hathaway might seem ambitious, but consider this: Warren Buffett’s empire wasn’t built overnight. It was constructed through decades of non-stop learning, patient capital allocation, and the discipline to stick to a few core principles.

C.J. has those same ingredients. The key difference? He’s just getting started. (Not to mention, he’s done a ton of philanthropy as well, but that’s a story for another day.)

So maybe the question isn’t whether C.J. is building a modern day Berkshire Hathaway. The real question is: when will his legacy off the court become the new standard for the next generation of athletes the way Warren Buffet inspired countless investors who came after?

Keep up with C.J. on LinkedIn, Twitter, or Instagram.

Subscribe to become a member. Join 4500+ athlete-investors, founders, and operators for stories on how athletes are building wealth, influence, and legacy after the game.

Follow us on LinkedIn and Instagram.

Want to be featured on mainstreet media or know someone we should feature? Let’s connect.

More stories like this dropping soon. Stay tuned.

Check out more stories here:

Infiltrating Silicon Valley: How Chase Garbers Is Hunting Unicorns

At 26, most people are still figuring out how their 401k works. Chase Garbers? He’s now a wealth advisor at a $40 billion wealth management firm, advising individuals and families worth hundreds of millions on how to grow their wealth.

From the NFL to Acai Bowls: How Henry Anderson Is Building a Multi-Million Dollar Franchise Empire

Every retired athlete faces the same inevitable question: What happens when the game ends?

His pickleball investment is fasinating timing. Getting a stake in Major League Pickleball before it exploded shows real court vision off the court. The part about mastering fundamentals with vending machines before scaling to bigger bets is smart. Most athletes jump straight to the flashy investments without understanding basic unit economics first.