Infiltrating Silicon Valley: How Chase Garbers Is Hunting Unicorns

From the NFL to venture capital, the former Raiders quarterback is proving that athletes can play Silicon Valley’s toughest game.

At 26, most people are still figuring out how their 401k works. Chase Garbers? He’s now a wealth advisor at a $40 billion wealth management firm, advising individuals and families worth hundreds of millions on how to grow their wealth.

The former Raiders quarterback didn’t just stumble into elite finance circles. He engineered his way in. Most retired athletes gravitate toward real estate or franchises. Not Chase. He’s hunting unicorns.

“The goal is to invest in the next Uber before they become household names.”

It’s a bet on asymmetric returns. His thesis is simple: life-changing wealth is rarely made through collecting rental income on an Airbnb property or owning a piece of a restaurant. It comes from owning a small piece of the next Uber before anyone knows what Uber is.

No Instagram-worthy properties to flex. No celebrity chef partnerships to announce. Just quiet bets on startups that could turn $25,000 into $125 million.

The venture capital world was built for tech insiders, not guys like Chase. But over the years, he’s quietly assembled a portfolio spanning more than a dozen startups through direct investments, syndicate deals, and co-investments alongside established funds. What started as personal curiosity has evolved into lived experience - a competitive edge he now brings to advising clients on venture capital, and knowledge he shares with fellow athletes navigating the same journey.

The Outsider’s Dilemma

“It’s so network and relationship driven,” Chase explains. Venture capital built Silicon Valley’s fortunes, and it remains largely inaccessible to outsiders who lack the right connections.

Most investment opportunities come with clear on-ramps. Venture capital comes with invisible barriers.

Want to buy Tesla stock? Download Robinhood, fund your account, and hit “buy.” Looking for real estate opportunities? Browse Zillow, call a realtor, and start house hunting. But venture capital? It’s a game of who you know. The best investment opportunities are often invite-only.

Most of the hottest startups raise money quietly from their existing networks before ever announcing they’re fundraising publicly. These deals happen in private chats and weekend dinners between insiders who’ve known each other for years.

“If you’re not already in the room, you’re not getting in.”

But here’s what the venture capital world often overlooks: athletes can be a cheat code for founders. They bring more than just capital. They bring built-in distribution through their audience, credibility and cultural influence that most investors lack, and a lived experience that founders can actually relate to.

Making it to the NFL and building a startup may look worlds apart, but at their core, they’re not that different. Both demand years of grinding through uncertainty, tuning out the doubters, and betting on potential very few people can see. So when a founder is having their darkest moment at 2am wondering if they should quit, who better to get advice from than someone who’s lived through the same struggle?

Yet athletes are often seen as tourists with deep pockets, not strategic partners.

The missed opportunity cuts both ways. Athletes are locked out of one of the rare investment strategies that can create generational wealth, while founders miss out on investors who bring more than just money.

For Chase, recognizing this gap was all the motivation he needed. “The first time I participated in a venture deal, I knew this was where I wanted to be,” Chase reflects. “Sure, it’s network-driven, but I spent my whole career building relationships with teammates, coaches, agents. I knew I could figure this out.”

Breaking Down Walls

Chase didn’t wait for an invitation to join the venture capital world. He crashed the party.

The foundation was laid long before he ever stepped foot in an NFL locker room. While most college athletes were focused solely on making it to the pros, he was already thinking beyond football. At UC Berkeley, he landed an internship position with a family office that was deploying millions across venture capital, private equity, and sports ownership deals.

The role opened his eyes to how generational wealth gets built. He sat in on investment committee meetings, learned how to conduct due diligence, and watched decisions that moved millions of dollars. But the real game-changer was the employee co-investment program that that let him put his own money alongside the family’s investments in a venture deal.

After that, Chase was hooked. The uncertainty, the potential, the rush of possibly finding the next unicorn - it gave him the same adrenaline rush as a fourth-quarter comeback.

Even after making it to the NFL, he brought his passion for investing to the Raiders’ locker room. Every week, he’d organize “Finance Fridays”, walking teammates through market news and investment opportunities. Those sessions weren’t just about educating his teammates. He was sharpening his own financial instincts while still in uniform. And when teammates started seeking him out for investment advice, something clicked. “That’s what got the wheels turning in my head. I realized I have a passion for investing and I can go down this path once football is over,” he recalls.

The breakthrough came when Chase realized that he didn’t need permission to invest in venture capital. Instead of waiting for opportunities to present themselves, he created his own.

He was intentional from the start and his approach was methodical. He researched funds that matched his interests, studied their portfolios, and then reached out with thoughtful questions and offered to help where he could. He didn’t just show up as “the NFL guy”. He led with substance, positioning himself as someone who could add value, and walked into every coffee chat having done his homework.

“What started as casual coffee chats turned into real relationships, and real relationships turned into investment opportunities,” he says.

When investors mentioned portfolio companies needed athlete partnerships, he offered introductions - no strings attached. When founders needed feedback on products targeting athletes, he became an informal advisor.

By the time Chase’s NFL career ended, he had already built a portfolio spanning AI, Fintech, Proptech, SaaS, Sports, and more. Not bad for someone whose day job involved getting hit by 300-pound linemen.

Turns out, venture capital rewards the same mentality that gets athletes drafted: show up, prove you belong, earn your spot on the roster.

From Outsider to Insider

Chase’s venture capital journey is just getting started, but he’s already learned the industry’s most important lesson: the asset class operates on what insiders call the “power law.” The math is unforgiving but simple. Most investments will fail. A few will break even. One or two might generate the kind of returns that make his NFL contracts look like pocket change. He’s learned to embrace that reality and trust the process.

“It’s a lot like baseball. You strike out most of the time, but you learn from those moments and eventually you get on base and you hit the double, the triple, and the grand slam.”

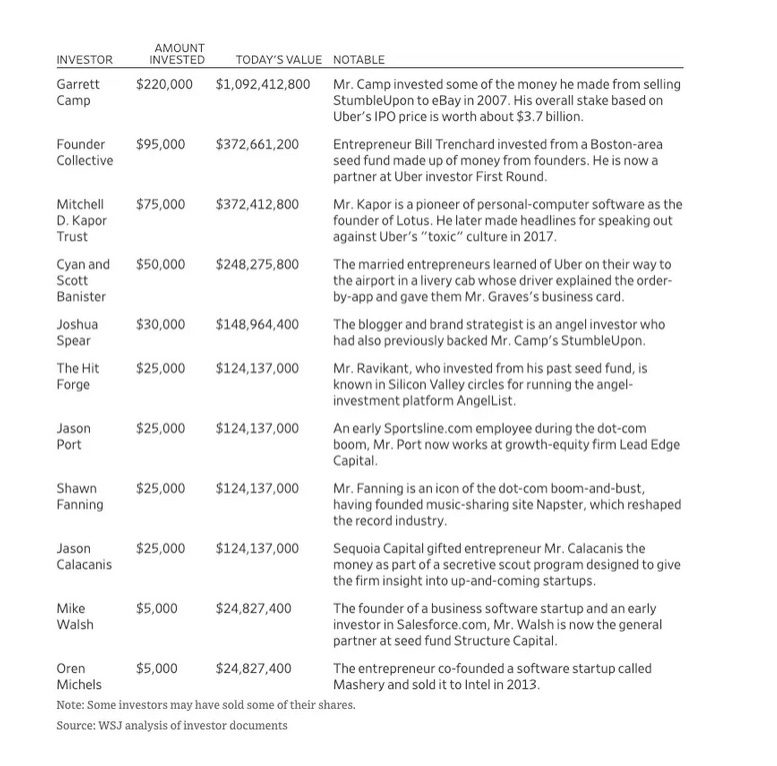

The key is building enough at-bats to catch the outliers. The numbers sound made up until you see them. Early Uber investor who wrote a $220,000 check walked away with over $1 billion when the company went public. Airbnb’s seed investors saw their small bets generate more than 1,000x returns. Retail investors who got into Revolut early have seen 400x returns, effectively turning a $10,000 investment into $4 million.

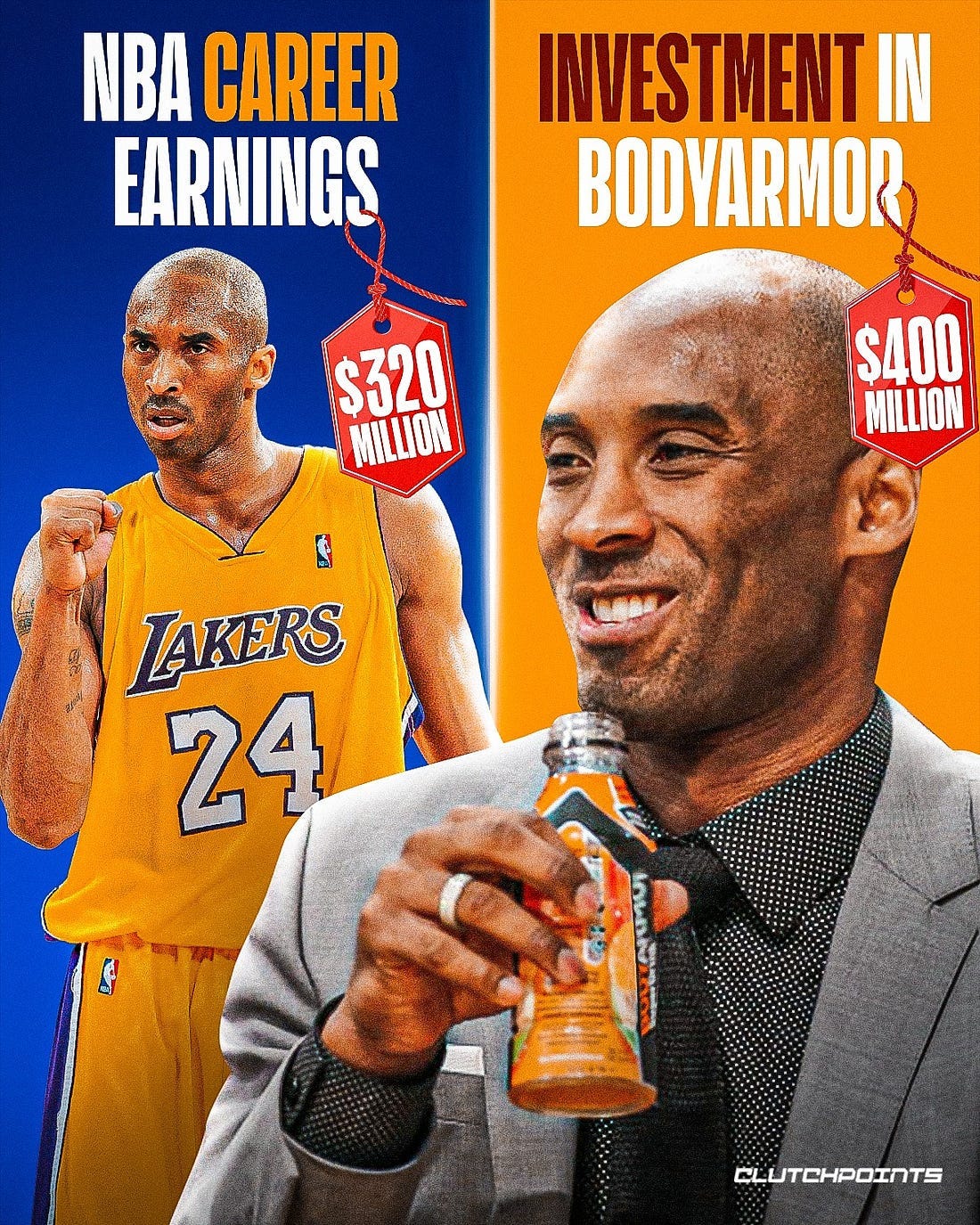

Chase isn’t alone. A quiet shift is happening in professional sports. While headlines focus on contracts and endorsements, athletes are starting to discover venture capital’s potential.

NBA legend Kobe Bryant’s BodyArmor bet generated $400 million after Coca-Cola’s $5.6 billion acquisition. NBA All-Star Kevin Durant’s early Postmates investment reportedly returned 15x when Uber acquired the company. A new generation of unicorns is emerging, and athletes who get in early are seeing returns that eclipse their playing careers.

“If you’re above a certain dollar amount, you should have venture capital in your portfolio. Whether that’s investing directly into startups or as an LP in funds, it really depends on your risk appetite. It’s high-risk, but some allocation to venture capital is important because of the potential returns.”

So what’s next for Chase? As a wealth advisor to high-net-worth individuals and families building nine-figure portfolios, he’s now focused on helping his clients gain exposure to venture capital, “an asset class where the top investors have outperformed the public markets by more than 70% over the past two decades,” he says.

For Chase, the game after the game is just getting started. And the secret weapon behind Silicon Valley’s fortunes? It’s not so secret anymore.

Follow along on LinkedIn or Instagram for a behind-the-scenes look at how Chase is navigating the venture capital world.

Subscribe to become a member. Join 4500+ athlete-investors, founders, and operators for stories on how athletes are building wealth, influence, and legacy after the game.

Follow us on LinkedIn and Instagram.

Want to be featured on mainstreet media or know someone we should feature? Let’s connect.

More stories like this dropping soon. Stay tuned.

Check out more stories here:

From the NFL to Acai Bowls: How Henry Anderson Is Building a Multi-Million Dollar Franchise Empire

Every retired athlete faces the same inevitable question: What happens when the game ends?