The Back to School Drop

founders are the new athletes. consider this a preseason watch list.

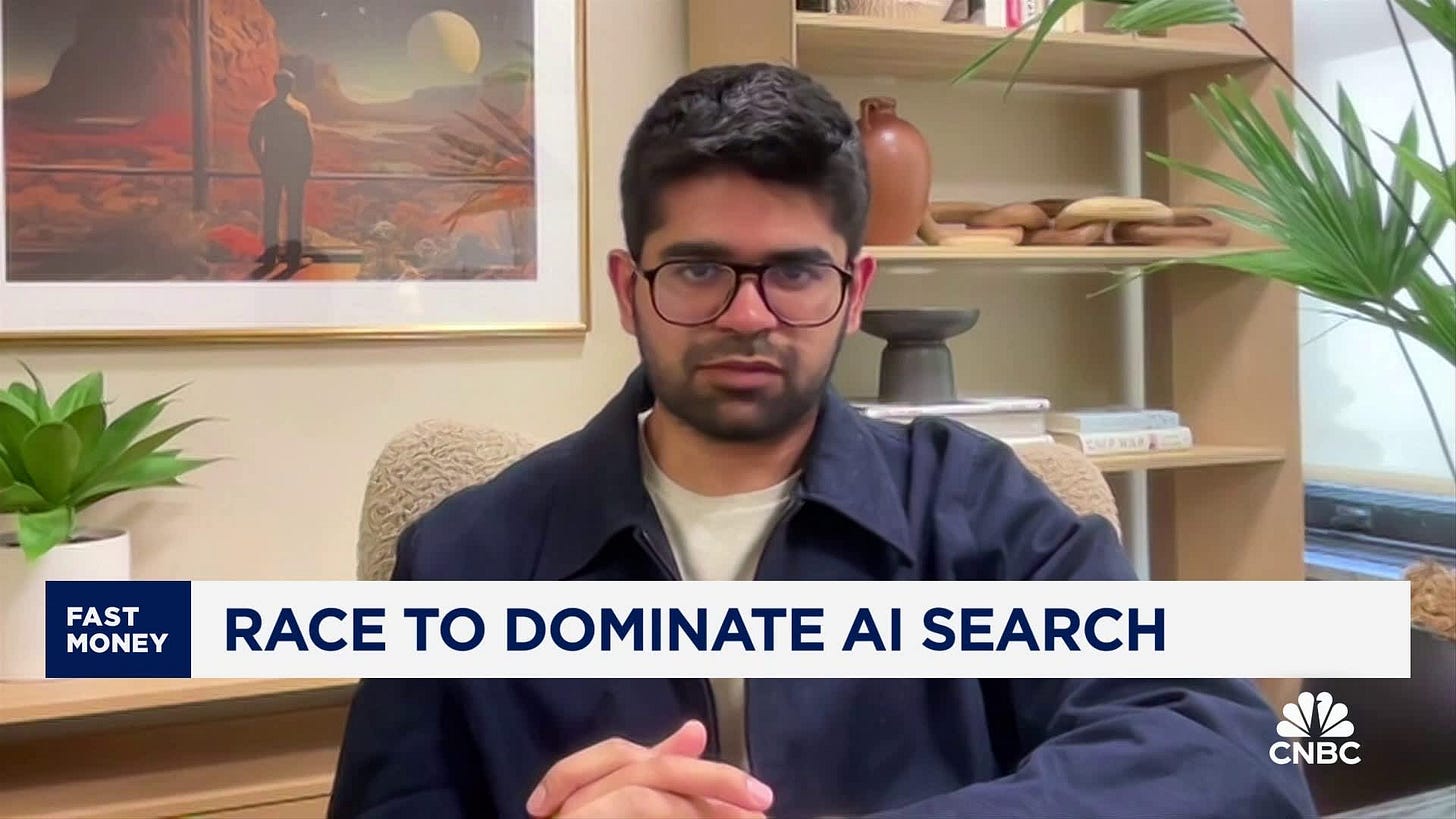

Perplexity has been getting busy.

The company is in talks to acquire Chrome from Google at a reported $35B price tag while also raising money at a reported $20B valuation.

31 year old founder Aravind Srinivas was named to the TIME100 Most Influential People in AI last year, alongside Mark Zuckerberg (Meta), Sam Altman (OpenAI), Mira Murati (Thinking Machine Labs), and others.

Earlier this summer, Perplexity closed a round of funding that valued the company at $18B, up 36x from the beginning of 2024 ($500M).

Aravind, a former UC Berkeley PhD, has quickly built one of the most valuable startups to come from a Cal alum in recent years.

That got me thinking: which colleges have the largest amount of ultra-right tail outcomes? Not just unicorns, but $10B+ private companies. Decacorns.

For this list, we analyzed the number of decacorns with at least one founder from the campus, then factored in the total amount of venture funding by founders from campus to come up with a proprietary score for each school.

Here’s what we found.

UC Berkeley | 92 OVR

UC Berkeley is consistently one of the top schools for startup founders in the U.S., and there’s even an argument for Cal at #1. No other school has near the same amount of undergrad founders - 1,811 as of 2024 according to Pitchbook - and Berkeley’s MBA and grad schools are top 10 and top 5 in number of founders, respectively.

Cal’s roster of decacorn builders lands them in the number four spot, but make no mistake, we are dealing with a heavyweight that can go toe-to-toe with any school.

MVP: Aravind Srinivas - Perplexity.

Easy choice given Perplexity’s visibility in an ultra-competitive AI search market. Aravind is the face of Perplexity, and by extension, MVP of the Golden Bears. A slightly less visible founder that has been just as dominant is Andy Konwinski, former founder at Databricks and current founder at Perplexity. Both Databricks and Perplexity have a few Cal alumni on their founding teams.

Aravind was a 28 year old AI researcher with previous internships at OpenAI and Google when ChatGPT dropped in 2022. He also spent a year working at OpenAI after his PhD at UC Berkeley. Seven days after ChatGPT dropped, Aravind dropped Perplexity. The difference between Perplexity and ChatGPT at the time was ChatGPT relied solely on its training data, whereas Perplexity could search the web and summarize the Internet with ease, akin to an AI infused Google. Two and a half years later, Aravind and his team have grown into an $18B valuation and have Jeff Bezos, NVIDIA, and Accel as investors.

Aravind Sriniva’s player comp is Tyrese Haliburton. Easy to forget about over the course of a season, especially relative to competitors like Sam Altman, but quietly efficient over the long-term and will string some loud moments together when you least expect it.

ROTY: Ritik Malholtra - Saavy Wealth.

Raised $72M in a Series B led by Industry Ventures, with participation from Thrive Capital. Saavy is a tech-enabled RIA and wealth management platform that has grown from 0 → $2.2B in 3 years. Not a unicorn yet, but well on their way if they can continue to execute in a crowded wealthtech space.

Way Too Early Stage: Karttikeya Mangalam - SigIQ AI.

Raised $9.5M in a seed round from GSV Ventures, The House Fund, Andy Konwinski (Perplexity co-founder) and General Catalyst India. Sig IQ AI is an AI powered personal tutor that reduces the cost of tutoring significantly while retaining the highest standard for tutor competence. When SigIQ’s AI model took the Indian UPSC civil service exam, it achieved the highest score in the exam’s history in just seven minutes.

Stanford University | 94 OVR

Stanford is head and shoulders ahead of the competition when it comes to cranking out unicorns. But this is a list on decacorns, and the school in Palo Alto - to my surprise - came in third. Their big three is large language model heavy, with Sam Altman (OpenAI - $500B) and Dario Amodei (Anthropic - $170B) as the main attractions. Ryan King (Chime - $12B IPO in June) also attended Stanford, and we opted to count any $10B+ IPOs that took place over the summer given the limited sample size.

MVP: Sam Altman - OpenAI

OpenAI is continuously pushing the limits of private startup valuation. Assuming they maintain a $500B valuation in a public offering, OpenAI would be the 18th most valuable company in the S&P 500 right now… More valuable than Costco, Bank of America, Goldman Sachs, Walt Disney, Uber, McDonald’s, and BlackRock, to name a few. Sam Altman is the definition of founder-celebrity, as arguably no one has benefited more from the ascent of artificial intelligence in mainstream culture. When OpenAI dropped GPT-5, media outlets compared it to an Apple event. When members of OpenAI’s executive team leave to start other companies, they raise billions off the bat with limited products or traction: Mira Murati secured $2B at a $10B valuation for Thinking Machines Lab, Ilya Sutskever raised $2B at a $32B valuation for Safe Superintelligence. OpenAI clout rivals that of any startup from any period of time. Altman, for better and worse, is the unanimous MVP.

Sam Altman’s player comp is Miami Heat Lebron James. The hype is unrivaled, the stats are borderline disrespectful, and the media coverage is suffocating.

ROTY: George Sivulka - Hebbia AI.

Last summer, Hebbia raised $130M at a $700M valuation in a round led by a16z. George Sivulka is a 27 year old prodigy that built Hebbia while working on his electrical engineering PhD at Stanford. The startup’s main product is Matrix, AI powered search and summarization for asset managers, investment banks, and other white collar firms. Hebbia claims that 30% of all asset managers use the product, and as of last summer, they were at $13M in annual recurring revenue. Will be interesting to watch how they grow into their valuation. Sivulka is known for his technical abilities - he finished his undergrad math program at Stanford in 2.5 years and worked at NASA as a teenager.

Way Too Early Stage: Shreyas Parab - DayDream Dental.

Super early nomination here - DayDream raised a $2.5M pre-seed round to provide full service dental billing that frees up your time for clinical and patient experience. While I won’t reveal specifics, Shreyas is far outperforming his rookie contract and DayDream’s traction is elite by any measure. Check out their recent podcast with Joe Lonsdale from Palantir.

MIT | 95 OVR

MIT has a lot more decacorn builders than you’d think: Greg Brockman (OpenAI - $500B), Patrick Collison (Stripe - $92B), Alexandr Wang (Scale AI - $29B) make up the starting line-up. Michael Truell (Anysphere / Cursor - $9.9B) can technically be included in the rotation as well. In addition, MIT’s ecosystem ranks high across the board in venture capital raised, with the undergrad program clocking in as top 5, grad program in the top 3, and business school in the top 8.

MVP: Alexandr Wang - Scale AI.

Some recency bias here - and in other MVP picks - due to Wang’s Meta deal and the buzz around Scale. Collison and Brockman both helped build companies with much larger valuations, but Wang is widely recognized as the true founder of Scale, while Brockman and Collison make up deeper rosters at OpenAI and Stripe, respectively. Will be interesting to watch what he does as the new face of Meta’s AI lab.

Alexandr Wang’s player comp is Shai Gilgeous-Alexander. A young prodigy with relentless focus on quiet execution, unorthodox style, and ability to deliver in the clutch.

ROTY: Tarek Mansour - Kalshi.

Around a month ago, Kalshi raised $185M at a $2B valuation in a round led by Paradigm. The prediction markets startup is going toe-to-toe with Founder’s Fund backed Polymarket, and Tarek Mansour is running point. Mansour graduated from MIT in 2018 and spent time at Goldman Sachs, Palantir, and Citadel before founding Kalshi in 2019.

Way Too Early Stage: Karun Kaushik - Delve.

Karun Kaushik is a 21 year old MIT student that dropped out to build Delve. Just five months after raising a $3M seed round, he spun the block and raised a $32M Series A at a $300M valuation in a round led by Insight Partners. Delve automates painful compliance processes for startups, including SOC 2, PCI, and GPDR. Their customer base has grown from 100 in January to 500 in July when they closed the Series A round.

Harvard | 95 OVR

Harvard edged out MIT by a few decimal points on the proprietary overall score. Johnny Ho (Perplexity - $18B), Eric Glyman (Ramp - $23B), Karim Atiyeh (Ramp - $23B), Parker Conrad (Rippling - $17B), John Collison (Stripe - $92B), and Greg Brockman (OpenAI - $500B) were all Harvard graduates or dropouts. Harvard’s schools all rank top 3 for total venture capital raised - #3 for the undergrad program, #2 for non-MBA grad schools, and #1 for the MBA program.

MVP: John Collison - Stripe

Felt like Collison is the obvious choice for MVP. He co-founded Stripe with his brother Patrick after dropping out of Harvard in 2010. Stripe is worth nearly $100B and it is the financial infrastructure for the Internet, the default back-end for a large part of the digital economy. John is also a relatively quiet operator and doesn’t chase PR or headlines. All of the power players in venture sit on Stripe’s cap table, including Founder’s Fund, a16z, and General Catalyst, to name a few.

John Collison’s player comp is Nikola Jokic. Highly efficient and strategic, leads by example, not controversial or super flashy.

ROTY: Adarsh Hiremath - Mercor.

Adarsh Hiremath dropped out of Harvard a few years ago to co-found Mercor with some friends from high school. Earlier this year, they raised $100M at a $2B valuation in a Series B round led by Felicis. Mercor uses AI to streamline hiring and had around $100M of ARR when the round was announced. Their team is one of the most efficient from a labor capital perspective, with an estimated $4.5M of revenue per employee, which clears any other AI agent startup. Anysphere (Cursor) clocked in at $3.2M of revenue per employee and Lovable was at $2.2M per employee.

Way Too Early Stage: Jacob Fortinsky - Novig

Jacob Fortinsky co-founded Novig with his Harvard classmate Kelechi Ukah and the company raised an $18M Series A just a few weeks ago. Novig is a leading peer-to-peer sports prediction market backed by Forerunner, Y-Combinator, and Joe Montana. Unlike traditional sportsbooks, Novig allows users to trade directly against each other rather than with the house, eliminating hidden fees and biased odds.

Early Stage Watch List (Extendo Cut):

Todd Baldwin - Crafted (Princeton)

Sean Hargrow - Series (Yale)

Jarod Estacio - Grid (Hamilton)

Karttikeya Mangalam - SigIQ AI (UC Berkeley)

Shreyas Parab - DayDream Dental (Stanford)

Karun Kaushik - Delve (MIT)

Jacob Fortinsky - Novig (Harvard)

After spending an unreasonable amount of resources putting these rosters together, it became very apparent that there was no predictive rule in projecting success based on the founder’s educational background. Stanford founders are more likely to build unicorns than any other school, but indexing to a single campus doesn’t seem to be the most scalable, alpha-generating strategy. Especially if decacorns are the goal.

Palmer Luckey, the exited founder of Oculus VR ($2B acquisition) and current founder of Anduril ($30B valuation), went to Long Beach State before dropping out.

Chris Britt, founder of Chime Games ($12B IPO), went to Tulane.

Brett Adcock, founder of Figure ($40B valuation) went to the University of Florida.

Nonetheless, it was tons of fun to curate these groups of ambitious founders.

Let us know who we missed, and be on the lookout for more drops in due time